Automated trading is an excellent tool for developing strategies based on divergences and convergences between correlated markets. Intermarket analysis is a market-driven branch of technical analysis that studies the price relationships between different asset classes. Essentially, it is a form of macroeconomic analysis that examines the dynamics behind major intermarket correlations observed over the past 50 years.

Introduction to Intermarket Analysis

As global financial markets become more interconnected, new intermarket correlations continue to emerge. Modern financial market analysis should incorporate an intermarket approach to capture these relationships. However, it is important to note that intermarket correlations are not static — they evolve over time in response to changes in the macroeconomic environment. Inflation and interest rates are key drivers behind shifts in these relationships. Intermarket linkages tend to strengthen significantly during periods of financial crisis.

The Important Role of Interest Rates

Interest rates, closely tied to inflation, play a crucial role across all financial markets. To illustrate how intermarket relationships contribute to a macroeconomic cycle, consider the following example:

An Example of How the Macroeconomic Cycle Works

-

The Federal Reserve (FED) unexpectedly lowers interest rates, which immediately weakens the US dollar exchange rate.

-

A weaker dollar boosts commodity prices.

-

Rising commodity prices push inflation higher.

-

Higher inflation forces the FED to raise interest rates — marking the middle phase of the cycle.

-

As interest rates rise, bond prices and stocks tend to fall. Investment projects are postponed, consumption declines, and unemployment rises.

-

Higher interest rates also strengthen the dollar exchange rate.

-

As the dollar strengthens, commodity prices decline.

-

Inflation diminishes, prompting the central bank to consider lowering interest rates again.

At this point, the macroeconomic cycle completes and may begin anew.

Lessons from Murphy’s Intermarket Analysis

John Murphy is renowned for his pioneering work on intermarket correlations and for clarifying the rules and principles under which these relationships may sometimes break down.

According to Murphy, all markets are interconnected—what happens in one market inevitably impacts others. At the macro level, the key interrelated asset classes include:

- Bonds

- Stock markets

- Currencies (Forex)

- Energies (with a focus on oil)

- Industrial metals (such as copper and aluminum)

- Precious metals (primarily gold)

No market moves in isolation. Therefore, analyzing any one market should always take into account the behavior of the others.

Examples of Intermarket Relationships (According to Murphy)

-

Commodity prices tend to move inversely to the US dollar.

A falling dollar is generally bullish for commodities.

-

A rising US dollar is usually positive for US stocks and bonds.

-

Bond prices move inversely to interest rates. However, commodities move inversely to bond prices.

Therefore, commodities generally move in the same direction as interest rates.

-

Rising bond prices typically benefit stocks and the bond market; however, during deflationary phases, bond prices can rise while stocks fall.

-

Commodities usually move in the same direction as bond yields and in the opposite direction to stocks.

Table: General Intermarket Trends

|

MACRO EVENT |

BOND PRICES |

EQUITY PRICES |

ENERGY PRICES |

INDUSTRIAL METALS |

GOLD PRICE |

|

INTEREST RATES RISING |

DOWN |

DOWN |

UP |

UP |

DOWN |

|

INTEREST RATES DECLINING |

UP |

UP |

DOWN |

DOWN |

UP |

|

US DOLLAR MAJOR RISING |

UP |

UP |

DOWN |

DOWN |

DOWN |

|

US DOLLAR MAJOR DECLINING |

DOWN |

DOWN |

UP |

UP |

UP |

|

DISINFLATION ENVIRONMENT |

UP |

UP |

DOWN |

DOWN |

UP/DOWN |

|

DEFLATION ENVIRONMENT |

UP |

DOWN |

DOWN |

DOWN |

DOWN |

Interpreting the Chart: Bond Yields, Commodities, and Stocks

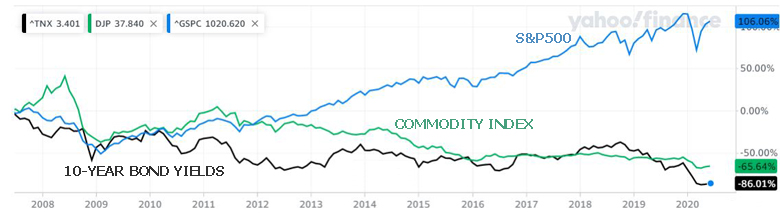

The below chart illustrates the inverse relationship between bond yields and commodities on one side, and stocks on the other. It’s important to remember that bond prices and bond yields move in opposite directions—when bond prices rise, yields fall, and vice versa.

-

As bond yields increase, commodity prices tend to rise as well, reflecting higher inflation expectations or economic activity.

-

Conversely, stock prices often move inversely to rising bond yields, as higher yields can increase borrowing costs and reduce corporate profits.

This dynamic highlights how bond yields serve as a critical pivot point influencing both commodities and stock markets in opposite ways.

The charts includes:

- Treasury Yield (^TNX) Return (10-Years)

- Bloomberg Commodity Index (^DJP) Total Return (SM) ETN

- S&P 500 (^GSPC) Return

Chart: Bond Yields, Bloomberg Commodity Index, and S&P 500

Financial Crisis Strengthens Intermarket Correlations

Global financial markets became highly correlated after 1998, primarily due to overinvestment in technology stocks during the late stages of the Nasdaq bubble—and the subsequent global stock market collapse after the bubble burst. The near-simultaneous collapse of virtually all world markets after 2000 raised doubts about the benefits of global diversification. During global bear markets, all major markets tend to move closely together on the downside, including equities, interest rates, exchange rates, and inflationary or deflationary trends.

The US Dollar

A key intermarket relationship is the inverse correlation between the US dollar and commodity prices, especially gold. A falling dollar tends to be inflationary and usually coincides with rising commodity prices, while a rising dollar has the opposite effect.

A rising dollar generally supports stocks and bonds. A falling dollar is bearish for both, but only if accompanied by rising commodity prices. However, a falling dollar can coexist with rising bond and stock prices if commodity prices remain stable.

Inflation and Deflation

According to Murphy, deflation became a major factor after 1998. For example, from 2000 to 2002, deflationary pressures made bonds a much stronger asset class than stocks. The 1970s experienced runaway inflation, favoring commodities, while the 1980s and 1990s were marked by disinflation, falling commodity prices, and strong bull markets in bonds and stocks.

Disinflation (1981-1997) hurts commodities but benefits bonds and stocks. Deflation (starting in 1998) benefits bonds and harms commodities, but also negatively affects stocks. In deflationary environments, bond prices rise as interest rates fall; however, falling interest rates do not boost stocks.

Strong deflationary trends may lead to a major shift in the bond-stock relationship (decoupling), where bond and stock prices move in opposite directions.

Intermarket Correlations Depend on Inflation/Deflation

(A) Inflationary Environment

In a typical inflationary environment, equities and bonds are positively correlated, while the US dollar and commodities move inversely.

-

Equities and Bonds: Positive Correlation

-

US Dollar and Commodities: Inverse Correlation

(B) Deflationary Environment

During deflation, equities and bonds show an inverse correlation. Equities also tend to have a positive relationship with interest rates.

-

Equities and Bonds: Inverse Correlation

-

US Dollar and Commodities: Inverse Correlation

-

Commodities and Bonds: Inverse Correlation

-

Equities and Commodities: Positive Correlation

Commodity Prices and Industrial Metals

Bond and commodity prices always move in opposite directions. Rising commodity prices signal increasing inflationary pressure, which pushes interest rates higher and bond prices lower. Conversely, commodity prices and bond yields generally move in the same direction. Commodity prices often change direction ahead of bonds, making them a leading indicator of bond prices at key turning points.

-

It is important to focus on individual commodities tied to the economy rather than general commodity indices.

-

Agricultural commodities are more influenced by weather than by economic trends.

-

Commodity sectors like industrial metals (especially aluminum and copper) are highly sensitive to economic trends.

Energy Prices

Rising oil prices have contributed to every US recession since 1970. When oil prices surge, the Federal Reserve is typically forced to raise interest rates.

According to Murphy, the US economy experienced four recessions between 1970 and 2000—in 1974, 1980, 1990, and 1999—all accompanied by surging oil prices. The 2008 financial crisis also coincided with a record oil price (crude oil peaked at $164 in June 2008).

A sharp rise in oil or gold prices sends an immediate warning to bond traders and an early signal to stock traders. When both commodities rise simultaneously, it poses a particularly serious threat to bonds and stocks.

The CRB/Bond Ratio and Stocks

Murphy uses the CRB/bond ratio as a simple indicator of the economy’s inflationary phase:

CRB Commodity Index Price / Price of Treasury Bonds (or T-Notes)

A rising CRB/bond ratio generally signals rising inflation and higher interest rates, which is negative for the overall stock market. However, in such periods, commodity prices outperform bond prices, and commodity-related stocks (basic materials, aluminum, copper, gold, energy) tend to outperform the broader market.

In deflationary periods, rising commodity prices are generally positive for stocks.

Key observations:

-

A rising commodity/bond ratio favors inflation-sensitive stocks such as gold mining, energy, and basic materials (aluminum, copper, paper, forest products).

-

A falling commodity/bond ratio favors interest-rate-sensitive stocks like consumer staples, utilities, healthcare, and financials.

Early Signs of Stock Market Reversals

Financial markets typically anticipate economic trends six to nine months in advance. The US dollar and commodity prices provide early warnings of strong inflationary or deflationary trends, while bond prices signal changes in interest rates and equity prices.

-

Industrial metal prices offer early warnings of economic transitions.

-

Energy stocks often change trend ahead of energy prices, which lead oil prices.

-

Higher energy prices warn of rising inflation and interest rates.

-

Commodity prices often lead bonds at important turning points.

-

Bonds tend to turn before stocks, acting as a leading indicator.

-

The NYSE Advance-Decline line usually moves ahead of the main US equity indices.

-

In major downtrends, technology stocks decline first, followed by transportation stocks (the reverse occurs in uptrends).

-

Sector rotations can provide early signals for major market shifts (e.g., moving from late expansion to early contraction).

-

The stock market typically peaks six to nine months before the economy.

-

An inverted yield curve strongly signals an approaching recession (younger bond yields exceed older bond yields).

Intermarket Correlations are Dynamic

Intermarket correlations are crucial and modern analysis should include an intermarket approach. However, these correlations are not static—they change with the macroeconomic environment. Correlations can pause or even reverse temporarily but usually return to normal over time. The key factors that validate intermarket relationships are inflation and the US dollar’s exchange rate.

■ George Protonotarios, financial analyst

for ForexAutomatic.com, copyright (c) all rights reserved

Resources:

- Intermarket Analysis: Profiting from Global Market Relationships (John Murphy 2004)

- Intermarket Technical Analysis: Trading Strategies for the Global Stock, Bond, Commodity, and Currency Markets (John Murphy)

- Think Like a Whale Trade as a Shark: Combining Fundamentals, Technical Analysis, and Market Sentiment to Trade Forex, Equities, and Cryptocurrencies (George Protonotarios 2020)

![]() READ MORE ON FOREX AUTOMATIC

READ MORE ON FOREX AUTOMATIC

• COMPARE

□ Compare Expert Advisors

□ Compare Trade Systems

□ Compare Platforms

□ Compare Forex Brokers

• GUIDES

► Get Started

► Automated Trading

► Forex Rollover Rate

► Automated Strategies

► Intermarket Analysis

► Learning Systems

► Trading Tips

► Money Management

► Forex Scalping

• EAs

► Expert Advisors Guide

► Building Custom EAs